Author: zefram.eth; 0xmcfly.eth

This proposal is expected to appear on Snapshot for voting on December 15, 2021 8:00 AM PT. Make sure to stake your MPH on Ethereum mainnet for voting before this date and time to participate in the DAO decision. Only xMPH holders will be allowed to vote.

Specification

This document proposes a redesign of 88mph’s tokenomics, specifically the token supply, issuance, and incentives.

Capped token supply, renegotiable after 4 years

The total supply of the MPH token will be capped at 1,888,888 tokens.

To avoid a limitation on the future growth of 88mph, the keys to mint MPH tokens will not be burnt, so that after January 1, 2026 (in 4 years), MPH holders may vote to ratify a new token supply cap if desired.

Token issuance schedule

As of writing, the MPH total supply is roughly 417k tokens. With a cap of 1,888,888 tokens, and accounting for potential token issuance between the writing of this proposal and its implementation, roughly 1.4M tokens remain to be issued over the next 4 years.

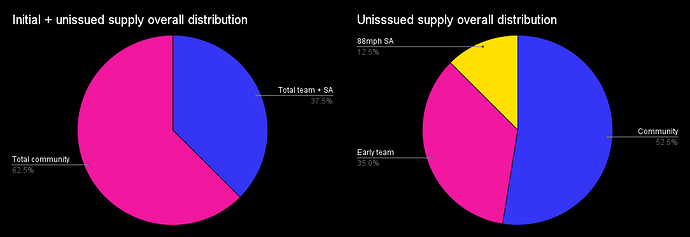

So the total supply (initial 419K + 1.4M unissued supply) will be distributed as such:

- 62.5% to community

- 37.5% to team, advisors, and future employees with 4 years vesting.

The unissued supply of 1.4m will be distributed as such:

- 52.5% to community

- 35% to early team and advisors

- 12.5% to 88mph SA

We think that this total supply distribution is in line with the industry standards (for eg. Curve.fi or Frax.finance distribution)

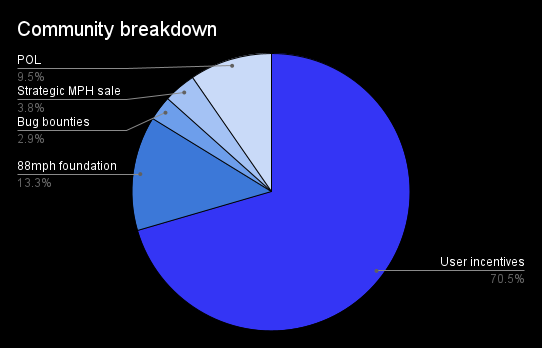

Community breakdown (52.5% of unissued MPH)

- 70.5% will be used for incentives to 88mph users over a 4-year distribution schedule:

- 46.2% will be used for incentives in 2022, which will be immediately minted after the passage of this proposal to prepare for distribution.

- 30.8% will be used for incentives in 2023

- 15.4% will be used for incentives in 2024

- 7.7% will be used for incentives in 2025

- 13.3% is being allocated to the 88mph foundation under creation in Geneva that is subject to a 10-year unlocking schedule. The 88mph foundation is a way to steward the protocol into the future and distribute grants to developers and contributors. The foundation aims to progressively decentralize how the governance treasury resources are allocated and work with 88mph Council to make decisions in the best interest of the protocol ecosystem.

- 9.5% will be immediately minted and unlocked to acquire protocol-owned liquidity via Olympus Pro or similar.

- 2.9% will be immediately minted and unlocked to support a bug bounty program denominated in MPH.

- 3.8% will be immediately minted and sold to strategic community members by the foundation to have operational funds at launch. This strategic allocation will be locked up for 1 year.

Early team and advisors (35% of unissued MPH)

The early team consisted of 2 founders, and multiple contractors, and advisors. Founders, contractors, and advisors will be on standard 4-year vesting schedules.

The early team is a group of passionate developers, product builders, and business leaders, dedicated to the Ethereum Ecosystem. This team delivered many innovative products since 2017 through various market conditions. They’ve created significant value for 88mph and proven their talent, commitment, work ethic, and execution ability.

88mph SA (12.5% of unissued MPH)

88mph is the commercial entity developing 88mph protocol since January 15, 2021. This Swiss entity will continue to grow as the standalone organization contributing to The 88mph ecosystem. The organization has no external shareholders and will be under a 4-year vesting schedule.

- 64.3% will be used to fund future developments of the protocol and its associated costs (contractors, audits, taxes, etc).

- 28.6% will be allocated to future employees with vesting.

- 7.1% will be immediately minted and unlocked.

If the governance decides to renegotiate the MPH supply cap after 4 years, the schedule for the increased issuance will be decided by governance at that point in time.

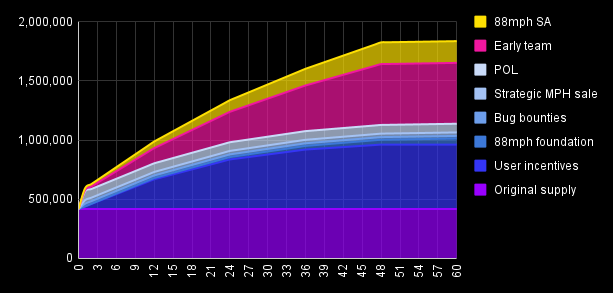

5-year MPH circulation schedule by buckets (cumulative)

Gauge-based incentives & veMPH

88mph will adopt a new system for allocating user incentives, adapted from gauges pioneered by Curve Finance and Frax Finance. MPH holders will be able to lock up their MPH tokens for up to 4 years in exchange for veMPH, which provides the right to vote on gauge weights, earn protocol revenue, and vote in governance proposals to control fees and protocol parameters, new asset listing, etc.

Each 88mph pool will be regularly allocated MPH incentives based on gauge weights. 88mph depositors will earn these incentives automatically when they deposit and may get diluted when more deposits are made similar to Synthetix-style staking pools. Deposits made before the passage of this proposal will still get their promised MPH incentives.

MPH incentives to yield token buyers will be deprecated. Existing yield token buyers will still get their promised MPH incentives.

xMPH will be gradually phased out, in favor of veMPH. To make the transition less impactful on existing xMPH holders, staking rewards will be initially distributed to both xMPH holders and veMPH holders, and move towards distributing all staking rewards to veMPH holders in the following fashion:

- In Q1 2022, 50% of rewards will be distributed to veMPH holders, and 50% to xMPH holders.

- After Q1 2022, 100% of rewards will be distributed to veMPH holders.

Notes: the gauges & veMPH will live on mainnet, and the farming pools on other chains will receive tokens directly from the mainnet gauges.

Gradually phase out MPH incentives for new users

Currently, the more the 88mph TVL grows, the more MPH is minted. This creates downward price pressure for MPH, which is not ideal.

After this proposal is approved, the current MPH incentive model will be gradually phased out for any new deposits & yield token purchases. To make the transition less impactful on the protocol TVL growth during the transition, the current MPH issuance rate will be halved every month until the new tokenomics have been implemented. The halving process will be effective 1 month after this proposal is approved. Existing deposits & yield tokens will still receive their promised MPH rewards.

Revised protocol revenue distribution

Currently, 100% of the revenue of the 88mph protocol is distributed to xMPH holders. While this enables MPH holders to share in the protocol’s success, this deprives the protocol of many avenues of growth, such as using protocol revenue to acquire protocol-owned liquidity without much dilution to existing holders.

Therefore, we propose transitioning to a hybrid revenue distribution model:

- 50% of revenue will be distributed to xMPH and veMPH holders

- 25% of revenue will be given to the governance treasury to acquire protocol-owned liquidity

- 25% of revenue will be given to the governance treasury as working capital and metagovernance assets.

Argument for

More certainty about token supply & issuance

Currently, the MPH total supply is uncapped. This results in uncertainty about future MPH issuance rates and how to price MPH. Having a cap on the total supply and having a clear token issuance model will provide more certainty and confidence to MPH holders.

More conservative token incentives

Currently, the more value is deposited into 88mph, the more MPH is minted as incentives. While this provides strong incentives to grow the protocol TVL, this also dilutes existing MPH holders, which creates many undesired consequences.

With a fixed incentive schedule, more TVL will not lead to more token issuance.

Protocol-owned liquidity

Currently, 88mph uses protocols like Sushiswap to rent MPH liquidity by distributing MPH rewards to liquidity providers. However, as the rise of protocols such as Olympus DAO has shown, protocol-owned liquidity is superior to rented liquidity in terms of longevity and stability. Therefore, switching from renting liquidity to owning liquidity will enable MPH’s price to grow more organically.

Furthermore, because protocol revenue will be used to acquire protocol-owned liquidity, 88mph will be able to translate the growth of the protocol into the growth of MPH liquidity & price, and translate the growth of MPH’s price into the growth of the protocol, creating a positive reinforcement loop.

Additionally, keeping a % of the incentives harvested on the underlying protocols used by 88mph will strengthen our relationships with key partners in the DeFi ecosystem and act as a working capital growing the value of the governance treasury.

More incentive alignment between team & protocol

As of writing, the developer wallet contains 9753.90 MPH, accounting for only 2.3% of the total supply. This is much lower than the industry average and prevents the team from sharing in the success of the protocol. With the new issuance model, the team will own roughly 30% of the total supply, vested over 4 years, which gives the team more incentives to work on the protocol in the long term.

Increase demand for MPH

By adopting the gauge model and veMPH, there will be more demand for people to buy MPH on the market, lock it up to get veMPH, and vote on gauge weights & future incentives. This creates another use case for MPH, thus increasing the demand for purchasing MPH.

Required actions

- Deploy the new smart contracts for gauges & veMPH.

- Work on the necessary frontend updates simultaneously.

- Halve the MPH reward rate for all 88mph pools.

- Execute token mints that do not depend on the new smart contracts.

- Finish the 88mph foundation creation process (Foundation’s status has been validated by the authorities but not yet enacted).

- Begin working with protocols such as Olympus Pro to acquire protocol-owned liquidity for MPH.

- Deploy new contracts for the new revenue-sharing model.