introduction to ICHI <> MPH Collaboration

TLDR

- ICHI builds and incentivizes stablecoins for other projects, like $oneMPH - always redeemable 1:1 to USDC, and backed by USDC + your project token ($MPH).

- Benefits for MPH span from new yield opportunity for stablecoin deposits, a stable medium of exchange that can be used in MPH protocol services and gives value back to $MPH (requires $MPH to mint new $oneMPH), new product line based on $oneMPH stabelcoin bonds & more…

- Looking to get MPH’s community feedback and ideas on $oneMPH use-cases and potential collaborations.

Summary

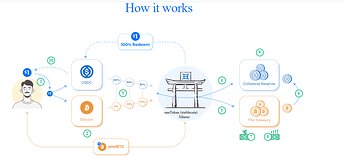

ICHI will launch $oneMPH - a stablecoin redeemable 1:1 for USDC, and backed by USDC + $MPH. $oneMPH can be used across MPH.finance as a stable medium of exchange governed by the stablecoin holders. Anyone can mint $oneMPH by supplying USDC and $MPH to the mint contract. This creates a reserve of USDC to ensure redemption at $1 and a community treasury of $MPH

How will it work ?

88MPH protocol is allowing users to lend their crypto assets at a fixed-interest rate. By doing so, they earn $MPH rewards and protocol’s revenues.

With over $40M TVL in various fixed rate bonds products, and a total of ~$5M in stablecoin based fixed-interest rate opportunities for depositing DAI/USDC/sUSD, there’s clearly market demand to earn interest on such products. $oneMPH - a stablecoin backed by USDC and $MPH can benefit directly the 88MPH community by introducing a token that is always redeemable 1:1 to USDC, and encourages demand for $MPH as it removes $MPH from circulation.

This will be driving alignment of interests between stablecoin depositors & protocol (as today users use other projects’ stablecoins to farm $MPH rewards which they will then sell for additional stablecoins).

Essentially ICHI helps to offset protocol farming rewards effect (inflation) with organic demand for the native token

Collaboration ideas:

ICHI to build $oneMPH stablecoin for the MPH community. From our experience talking to many project, there are multiple use cases for that, some ideas:

-

Fixed / floating interest rate bonds that use $oneMPH instead of other projects stablecoins

-

Treasury diversification - MPH can hold part of it’s treasury in a stable medium of exchange, while using $MPH token.

-

Pay contributors in stablecoins - giving them a way to hedge token volatility + generate demand for $MPH token (unlike using other stablecoins that require to give up on your token to acquire it)

-

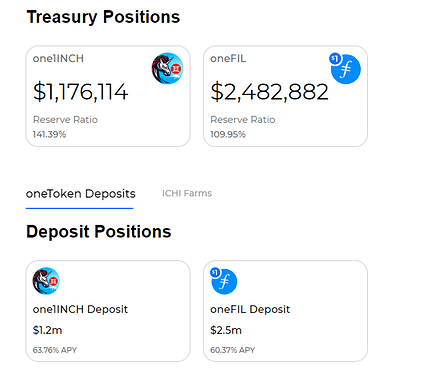

Whitlist 88MPH strategies as approved strategies to deploy capital locked on ICHI oneToken ecosystem: Example - oneBTC pool is a stablecoin backed by USDC and wBTC - with $1.5M one BTC minted - they hold $1.42M USDC and ~7 BTC. oneBTC holders, who govern this pool of token, can decide to take part of the USDC collateral and have it “work” using MPH fixed rate bonds.

-

oneMPH holders are the decision makers over the collateral and treasury - they can decide to use the USDC that users deposit to optimize the yield they get on their stablecoin.

And more…

About ICHI

ICHI is a family of stablecoins (coins valued at 1 USD) designed to drive scarcity of member coins (ie, $oneMPH = $1). ICHI exists to provide price stability and community treasury to projects like 88MPH, only the MPH community governs its stablecoin treasury.

ICHI is LIVE and works with coins and projects like BTC, ETH, LINK, and WING to enable them to grow their token economies.

How is the ICHI design better than other stablecoin designs?

The peg is guaranteed; redeeming $oneMPH will always get the equivalent in USDC. However, unlike USDC, ICHI is 100% on-chain and non-custodial.

When minting a $oneMPH - you deposit exactly $1 - no need for over-collateralization, or getting into a debt position as the case is with other stablecoin projects.

Who is behind ICHI?

ICHI was created with a top team of devs from Microsoft, Amazon, RedHat, and IBM. ICHI had a 100% fair launch and has been community-owned from the first block. There was no pre-sale, no initial team cut, etc.

ICHI already collaborates with top DeFi dex like Bancor (ICHI token whitelisted) Sushi and 1inch (rewards program in place), and Balancer.

Towards launch of V2 in a few weeks, ICHI completed an audit process with Quantstamp & Solidified, and is in discussions with top DeFi projects to add them on the list of new oneTokens release roadmap.

Read more:

Website - https://www.ichi.org/

dApp - ichi.farm

Docs- https://docs.ichi.farm/

Looking to get MPH’s community feedback and ideas on $oneMPH use-cases and potential collaborations.